Questions 31 through 33 refer to the following text.

The IRS Chief Counsel is appointed by the President of

the United States, with the advice and consent of the U.S.

Senate, and serves as the chief legal advisor to the IRS

Commissioner on all matters pertaining to the interpretation,

administration, and enforcement of the Internal Revenue

Code, as well as all other legal matters. Under the IRS

Restructuring and Reform Act of 1998, the Chief Counsel

reports to both the IRS Commissioner and the Treasury

General Counsel.

Attorneys in the Chief Counsel’s Office serve as lawyers for

the IRS. They provide the IRS and taxpayers with guidance

on interpreting Federal tax laws correctly, represent the

IRS in litigation, and provide all other legal support required

to carry out the IRS mission.

Chief Counsel received 95,929 cases and closed

94,323 cases during fiscal year 2012. Of the new cases

received, and cases closed, the majority related to tax law

enforcement and litigation, including Tax Court litigation;

collection, bankruptcy, and summons advice and litigation;

Appellate Court litigation; criminal tax; and enforcement

advice and assistance.

In Fiscal Year 2012, Chief Counsel received 31,295

Tax Court cases involving taxpayers contesting an IRS

determination that they owed additional tax. The total

amount of tax and penalty in dispute at the end of the fiscal

year was almost $6.6 billion.

(Source: Internal Revenue Service Data Book, 2012.)

During fiscal year 2012, the Chief Counsel’s office succeeded in

Questions 39 and 40 refer to the following text.

Customs enforcement is concerned with the protection of

society and fighting trans-national organized crime based

on the principles of risk management. In discharging

this mandate, Customs compliance and enforcement

services are involved in a wide range of activities relating

to information and intelligence exchange, combating

commercial fraud, counterfeiting, the smuggling of highly

taxed goods (especially cigarettes and alcohol), drug

trafficking, stolen motor vehicles, money laundering,

electronic crime, smuggling of arms, nuclear materials,

toxic waste and weapons of mass destruction. Enforcement

activities also aim to protect intellectual and cultural

property and endangered plants and animal species.

In order to assist its Members improve the effectiveness of

their enforcement efforts and achieve a balance between

control and facilitation, the World Customs Organisation

has developed a comprehensive technical assistance

and training programmes. In addition, it has established

Regional Intelligence Liaison Offices (RILOs) that are

supported by a global database, the Customs Enforcement

Network (CEN), to facilitate the exchange and use of

information.

The WCO has also developed instruments for international

co-operation in the form of the revised Model Bilateral

Agreement (MBA); the Nairobi Convention, which provides

for mutual administrative assistance in the prevention,

investigation and repression of Customs offences; and

the Johannesburg Convention, which provides for mutual

administrative assistance in Customs matters. The WCO’s

Customs Control and Enforcement programme therefore

aims to promote effective enforcement practices and

encourage co-operation among its Members and with its

various competent partners and stakeholders.

(Source: http://www.wcoomd.org/en/topics/enforcement-and-compliance/

overview.aspx, retrieved on 12 March 2014.)

The text explains that the mandate of the World Customs Organisation comprises both

Questions 31 through 33 refer to the following text.

The IRS Chief Counsel is appointed by the President of

the United States, with the advice and consent of the U.S.

Senate, and serves as the chief legal advisor to the IRS

Commissioner on all matters pertaining to the interpretation,

administration, and enforcement of the Internal Revenue

Code, as well as all other legal matters. Under the IRS

Restructuring and Reform Act of 1998, the Chief Counsel

reports to both the IRS Commissioner and the Treasury

General Counsel.

Attorneys in the Chief Counsel's Office serve as lawyers for

the IRS. They provide the IRS and taxpayers with guidance

on interpreting Federal tax laws correctly, represent the

IRS in litigation, and provide all other legal support required

to carry out the IRS mission.

Chief Counsel received 95,929 cases and closed

94,323 cases during fiscal year 2012. Of the new cases

received, and cases closed, the majority related to tax law

enforcement and litigation, including Tax Court litigation;

collection, bankruptcy, and summons advice and litigation;

Appellate Court litigation; criminal tax; and enforcement

advice and assistance.

In Fiscal Year 2012, Chief Counsel received 31,295

Tax Court cases involving taxpayers contesting an IRS

determination that they owed additional tax. The total

amount of tax and penalty in dispute at the end of the fiscal

year was almost $6.6 billion.

(Source: Internal Revenue Service Data Book, 2012.)

As described in the text, the mission of attorneys working in the Chief Counsel's Office includes:

Questions 39 and 40 refer to the following text.

Customs enforcement is concerned with the protection of

society and fighting trans-national organized crime based

on the principles of risk management. In discharging

this mandate, Customs compliance and enforcement

services are involved in a wide range of activities relating

to information and intelligence exchange, combating

commercial fraud, counterfeiting, the smuggling of highly

taxed goods (especially cigarettes and alcohol), drug

trafficking, stolen motor vehicles, money laundering,

electronic crime, smuggling of arms, nuclear materials,

toxic waste and weapons of mass destruction. Enforcement

activities also aim to protect intellectual and cultural

property and endangered plants and animal species.

In order to assist its Members improve the effectiveness of

their enforcement efforts and achieve a balance between

control and facilitation, the World Customs Organisation

has developed a comprehensive technical assistance

and training programmes. In addition, it has established

Regional Intelligence Liaison Offices (RILOs) that are

supported by a global database, the Customs Enforcement

Network (CEN), to facilitate the exchange and use of

information.

The WCO has also developed instruments for international

co-operation in the form of the revised Model Bilateral

Agreement (MBA); the Nairobi Convention, which provides

for mutual administrative assistance in the prevention,

investigation and repression of Customs offences; and

the Johannesburg Convention, which provides for mutual

administrative assistance in Customs matters. The WCO’s

Customs Control and Enforcement programme therefore

aims to promote effective enforcement practices and

encourage co-operation among its Members and with its

various competent partners and stakeholders.

(Source: http://www.wcoomd.org/en/topics/enforcement-and-compliance/

overview.aspx, retrieved on 12 March 2014.)

In accordance with the passage, ‘customs enforcement’ can best be defined as the prevention of criminal activities

Questions 31 through 33 refer to the following text.

The IRS Chief Counsel is appointed by the President of

the United States, with the advice and consent of the U.S.

Senate, and serves as the chief legal advisor to the IRS

Commissioner on all matters pertaining to the interpretation,

administration, and enforcement of the Internal Revenue

Code, as well as all other legal matters. Under the IRS

Restructuring and Reform Act of 1998, the Chief Counsel

reports to both the IRS Commissioner and the Treasury

General Counsel.

Attorneys in the Chief Counsel's Office serve as lawyers for

the IRS. They provide the IRS and taxpayers with guidance

on interpreting Federal tax laws correctly, represent the

IRS in litigation, and provide all other legal support required

to carry out the IRS mission.

Chief Counsel received 95,929 cases and closed

94,323 cases during fiscal year 2012. Of the new cases

received, and cases closed, the majority related to tax law

enforcement and litigation, including Tax Court litigation;

collection, bankruptcy, and summons advice and litigation;

Appellate Court litigation; criminal tax; and enforcement

advice and assistance.

In Fiscal Year 2012, Chief Counsel received 31,295

Tax Court cases involving taxpayers contesting an IRS

determination that they owed additional tax. The total

amount of tax and penalty in dispute at the end of the fiscal

year was almost $6.6 billion.

(Source: Internal Revenue Service Data Book, 2012.)

According to the passage, the IRS's chief legal advisor is

Questions 34 through 38 refer to the following text.

We've been keeping our veterinarian in business lately.

First Sammy, our nine-year-old golden retriever, needed

surgery. (She's fine now.) Then Inky, our curious cat,

burned his paw. (He'll be fine, too.) At our last visit, as we

were writing our fourth (or was it the fifth?) consecutive

check to the veterinary hospital, there was much joking

about how vet bills should be tax-deductible. After all, pets

are dependents, too, right? (Guffaws all around.)

Now, halfway through tax-filing season, comes news

that pets are high on the list of unusual deductions

taxpayers try to claim. From routine pet expenses to the

costs of adopting a pet to, yes, pets as "dependents," tax

accountants have heard it all this year, according to the

Minnesota Society of Certified Public Accountants, which

surveys its members annually about the most outlandish

tax deductions proposed by clients. Most of these doggy

deductions don't hunt, but, believe it or not, some do. Could

there be a spot for Sammy and Inky on our 1040?

Scott Kadrlik, a certified public accountant in Eden Prairie,

Minn., who moonlights as a stand-up comedian (really!),

gave me a dog's-eye view of the tax code: "In most cases

our family pets are just family pets," he says. They cannot

be claimed as dependents, and you cannot deduct the

cost of their food, medical care or other expenses. One

exception is service dogs. If you require a Seeing Eye

dog, for example, your canine's costs are deductible as

a medical expense. Occasionally, man's best friend also

is man's best business deduction. The Doberman that

guards the junk yard can be deductible as a business

expense of the junk-yard owner, says Mr. Kadrlik. Ditto the

convenience-store cat that keeps the rats at bay.

For most of us, though, our pets are hobbies at most.

Something's a hobby if, among other things, it hasn't turned

a profit in at least three of the past five years (or two of the

past seven years in the case of horse training, breeding

or racing). In that case, you can't deduct losses—only

expenses to the extent of income in the same year. So if

your beloved Bichon earns $100 for a modeling gig, you

could deduct $100 worth of vet bills (or dog food or doggy

attire).

(Source: Carolyn Geer, The Wall Street Journal, retrieved on 13 March

2014 - slightly adapted)

The phrase “Guffaws all around" (paragraph 1) shows that those hearing the conversation

Questions 34 through 38 refer to the following text.

We've been keeping our veterinarian in business lately.

First Sammy, our nine-year-old golden retriever, needed

surgery. (She's fine now.) Then Inky, our curious cat,

burned his paw. (He'll be fine, too.) At our last visit, as we

were writing our fourth (or was it the fifth?) consecutive

check to the veterinary hospital, there was much joking

about how vet bills should be tax-deductible. After all, pets

are dependents, too, right? (Guffaws all around.)

Now, halfway through tax-filing season, comes news

that pets are high on the list of unusual deductions

taxpayers try to claim. From routine pet expenses to the

costs of adopting a pet to, yes, pets as "dependents," tax

accountants have heard it all this year, according to the

Minnesota Society of Certified Public Accountants, which

surveys its members annually about the most outlandish

tax deductions proposed by clients. Most of these doggy

deductions don't hunt, but, believe it or not, some do. Could

there be a spot for Sammy and Inky on our 1040?

Scott Kadrlik, a certified public accountant in Eden Prairie,

Minn., who moonlights as a stand-up comedian (really!),

gave me a dog's-eye view of the tax code: "In most cases

our family pets are just family pets," he says. They cannot

be claimed as dependents, and you cannot deduct the

cost of their food, medical care or other expenses. One

exception is service dogs. If you require a Seeing Eye

dog, for example, your canine's costs are deductible as

a medical expense. Occasionally, man's best friend also

is man's best business deduction. The Doberman that

guards the junk yard can be deductible as a business

expense of the junk-yard owner, says Mr. Kadrlik. Ditto the

convenience-store cat that keeps the rats at bay.

For most of us, though, our pets are hobbies at most.

Something's a hobby if, among other things, it hasn't turned

a profit in at least three of the past five years (or two of the

past seven years in the case of horse training, breeding

or racing). In that case, you can't deduct losses—only

expenses to the extent of income in the same year. So if

your beloved Bichon earns $100 for a modeling gig, you

could deduct $100 worth of vet bills (or dog food or doggy

attire).

(Source: Carolyn Geer, The Wall Street Journal, retrieved on 13 March

2014 - slightly adapted)

Among the domesticated animals considered eligible for tax deductions are

Questions 34 through 38 refer to the following text.

We've been keeping our veterinarian in business lately.

First Sammy, our nine-year-old golden retriever, needed

surgery. (She's fine now.) Then Inky, our curious cat,

burned his paw. (He'll be fine, too.) At our last visit, as we

were writing our fourth (or was it the fifth?) consecutive

check to the veterinary hospital, there was much joking

about how vet bills should be tax-deductible. After all, pets

are dependents, too, right? (Guffaws all around.)

Now, halfway through tax-filing season, comes news

that pets are high on the list of unusual deductions

taxpayers try to claim. From routine pet expenses to the

costs of adopting a pet to, yes, pets as "dependents," tax

accountants have heard it all this year, according to the

Minnesota Society of Certified Public Accountants, which

surveys its members annually about the most outlandish

tax deductions proposed by clients. Most of these doggy

deductions don't hunt, but, believe it or not, some do. Could

there be a spot for Sammy and Inky on our 1040?

Scott Kadrlik, a certified public accountant in Eden Prairie,

Minn., who moonlights as a stand-up comedian (really!),

gave me a dog's-eye view of the tax code: "In most cases

our family pets are just family pets," he says. They cannot

be claimed as dependents, and you cannot deduct the

cost of their food, medical care or other expenses. One

exception is service dogs. If you require a Seeing Eye

dog, for example, your canine's costs are deductible as

a medical expense. Occasionally, man's best friend also

is man's best business deduction. The Doberman that

guards the junk yard can be deductible as a business

expense of the junk-yard owner, says Mr. Kadrlik. Ditto the

convenience-store cat that keeps the rats at bay.

For most of us, though, our pets are hobbies at most.

Something's a hobby if, among other things, it hasn't turned

a profit in at least three of the past five years (or two of the

past seven years in the case of horse training, breeding

or racing). In that case, you can't deduct losses—only

expenses to the extent of income in the same year. So if

your beloved Bichon earns $100 for a modeling gig, you

could deduct $100 worth of vet bills (or dog food or doggy

attire).

(Source: Carolyn Geer, The Wall Street Journal, retrieved on 13 March

2014 - slightly adapted)

The opening sentence of the text reveals that the author has been

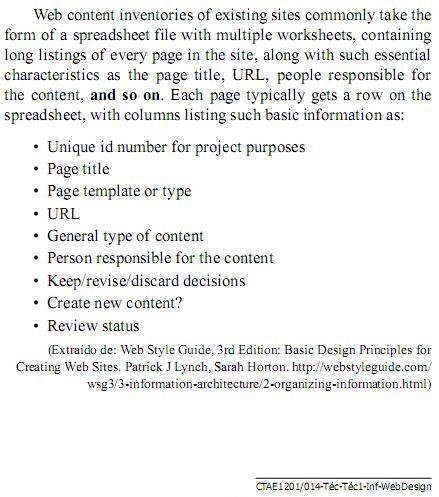

O texto a seguir deverá ser utilizado para responder às questões de números 56 e 57.

No texto, a expressão and so on pode ser substituída, sem perda de sentido, por:

Cada opção abaixo revela uma mensagem eletrônica que um aluno universitário enviou para uma universidade americana solicitando informações sobre os cursos de pós-graduação. Qual é a única opção que apresenta a mensagem gramaticalmente correta?

Look at the strip story below and answer the question that follows it.

In the sentence It´s hard to get mad at someone who returns things so promptly the relative pronoun who is being used to define the subject of a relative clause. Look at the sentences below and select the ones in which the underlined relative pronoun is used correctly.

I. The girl in pink is the one that I told you about.

II. Peter went to the restaurant which I eat.

III. The woman whose we met at the mall is a teacher.

IV. Do you know the Japanese guy with whom I travelled?

Choose the only correct alternative to fill in the blanks:

I. Brazil is ________ Argentina.

II. Japan is _________ Bolivia.

III. The Everest is _________mountain in the world.

IV. France is not __________ Canada.

Mark the alternative which is equivalent to: "Had I stopped" in the sentence below:

"Had I stopped at the red light, I wouldn´t have been involved in the accident."

Text 1

Source:http://www.niallferguson.com/site/FERG/Templates/General. aspx?pageid=194

The Ascent of Money

Synopsis

Bread, cash, dosh, dough, loot: Call it what you like, it matters. To Christians, love of it is the root of all evil. To generals, it's the sinews of war. To revolutionaries, it's the chains of labour. But in The Ascent of Money, Niall Ferguson shows that fi nance is in fact the foundation of human progress. What's more, he reveals fi nancial history as the essential back-story behind all history. The evolution of credit and debt was as important as any technological innovation in the rise of civilization, from ancient Babylon to the silver mines of Bolivia. Banks provided the material basis for the splendours of the Italian Renaissance, while the bond market was the decisive factor in confl icts from the Seven Years' War to the American Civil War.

With the clarity and verve for which he is famed, Niall Ferguson explains why the origins of the FrenchRevolution lie in a stock market bubble caused by a convicted Scots murderer. He shows how fi nancial failure turned Argentina from the world's sixth richest country into an infl ation-ridden basket case - and how a fi nancial revolution is propelling the world's most populous country from poverty to power in a single generation.

Yet the most important lesson of the world's fi nancial history is that sooner or later every bubble bursts - sooner or later the bearish sellers outnumber the bullish buyers - sooner or later greed fl ips into fear. And that's why, whether you're scraping by or rolling in it, there's never been a better time to understand the ascent of money.

The pronoun 'it' in paragraph 3 line 5 refers to