______ melodies tend to repeat every 20-30 seconds, which helps to explain why they are so special.

Assinale a alternativa cujo vocábulo destacado foi empregado de forma incorreta:

Based on the text, judge the following items.

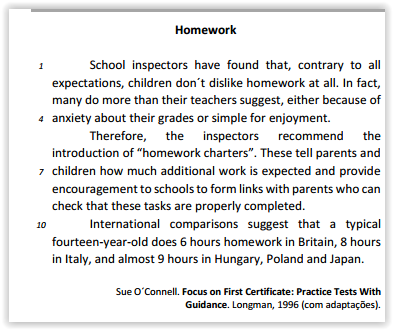

In “the inspectors” (line 5), the definite article can be omitted.

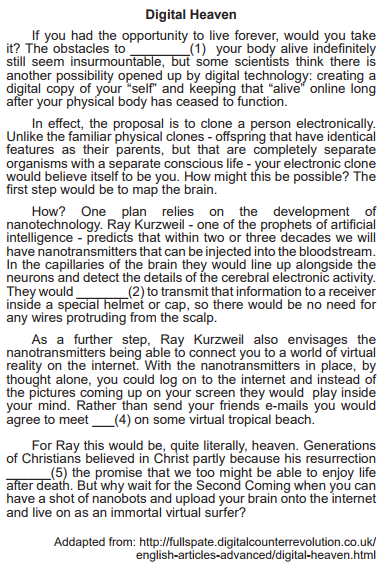

From question 53 to 63, choose the CORRECT answers to fll in the blanks.

What are the ingredients ____ cake?

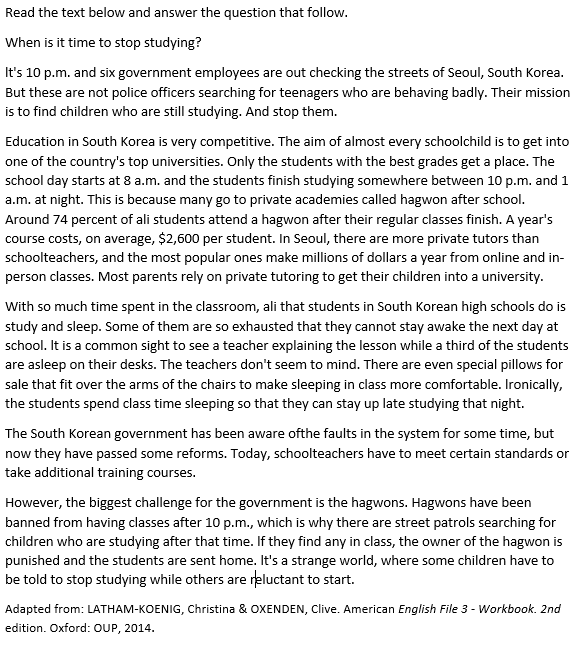

A questão refere-se ao texto seguinte:

O vocábulo “WISHES”, no texto, é exemplo de:

There are eight parts of speech in the English language: noun, pronoun, verb, adjective, adverb, preposition, conjunction, and interjection. The part of speech indicates how the word functions in meaning as well as grammatically within the sentence.

Based on the statement above, the words considered, naïve and especially (l. 9 and 10) can be respectively classifed as:

Notice the use of the article A in" ... to get their children into a university." (second paragraph) Choose the sentence in which the article wasn't properly used.

“we are oriented toward cars, which are an amazing technology that allow ____________________ independence.” Choose the best option to complete the sentence.

- A forma correta do discurso indireto para: “I am living here”, he said. É:

Choose the question we would ask to get the following answer: "The school day starts at 8 a.m." (2nd paragraph)

As opções abaixo revelam uma mensagem eletrônica que um cliente enviou para um hotel em Seattle nos EUA solicitando informações sobre a região em que o hotel está situado. Assinale a alternativa que apresenta a mensagem gramaticalmente CORRETA:

Choose the alternative that completes the sentence correctly.

You wouldn’t believe him, __________?

Questions 34 through 38 refer to the following text.

We've been keeping our veterinarian in business lately.

First Sammy, our nine-year-old golden retriever, needed

surgery. (She's fine now.) Then Inky, our curious cat,

burned his paw. (He'll be fine, too.) At our last visit, as we

were writing our fourth (or was it the fifth?) consecutive

check to the veterinary hospital, there was much joking

about how vet bills should be tax-deductible. After all, pets

are dependents, too, right? (Guffaws all around.)

Now, halfway through tax-filing season, comes news

that pets are high on the list of unusual deductions

taxpayers try to claim. From routine pet expenses to the

costs of adopting a pet to, yes, pets as "dependents," tax

accountants have heard it all this year, according to the

Minnesota Society of Certified Public Accountants, which

surveys its members annually about the most outlandish

tax deductions proposed by clients. Most of these doggy

deductions don't hunt, but, believe it or not, some do. Could

there be a spot for Sammy and Inky on our 1040?

Scott Kadrlik, a certified public accountant in Eden Prairie,

Minn., who moonlights as a stand-up comedian (really!),

gave me a dog's-eye view of the tax code: "In most cases

our family pets are just family pets," he says. They cannot

be claimed as dependents, and you cannot deduct the

cost of their food, medical care or other expenses. One

exception is service dogs. If you require a Seeing Eye

dog, for example, your canine's costs are deductible as

a medical expense. Occasionally, man's best friend also

is man's best business deduction. The Doberman that

guards the junk yard can be deductible as a business

expense of the junk-yard owner, says Mr. Kadrlik. Ditto the

convenience-store cat that keeps the rats at bay.

For most of us, though, our pets are hobbies at most.

Something's a hobby if, among other things, it hasn't turned

a profit in at least three of the past five years (or two of the

past seven years in the case of horse training, breeding

or racing). In that case, you can't deduct losses—only

expenses to the extent of income in the same year. So if

your beloved Bichon earns $100 for a modeling gig, you

could deduct $100 worth of vet bills (or dog food or doggy

attire).

(Source: Carolyn Geer, The Wall Street Journal, retrieved on 13 March

2014 - slightly adapted)

The title that best conveys the main purpose of the article is: